Maximize Savings with Education Loan EMI and Tax Benefits

It may appear that there is a big financial mountain to climb to acquire a higher education, but the cost can be easily reduced into smaller monthly payments through an education loan EMI (Equated Monthly Installment). An education loan EMI can not only take you to a great school with some clever planning. It is also capable of saving you a significant amount of money in clever repayment plans and tax breaks.

This is a step-by-step tutorial that demonstrates how you can get the best out of your college loan EMI. We will discuss ways of saving money to repay student loans using tax breaks and other convenient measures. This will assist the students and their families in achieving academic and financial objectives.

Education Loan EMI and Why Does It Matter?

Education Loan EMI refers to the amount of money that is monthly paid back on an education loan, both in terms of the principal and interest on the loan over a given period of time. It is one of the most important aspects of financial planning included in students because it makes college affordable and financially sustainable, which motivates them to remain on their budgets.

- Enhances Academic Opportunity: Education loan EMI allows students with varying economic backgrounds to meet their academic aspirations without fearing to pay tuition, accommodation, and other expenses simultaneously. Rather, they are able to allocate the expenses in months or years.

- Promotes Financial Discipline and Planning: EMI payments are constant and therefore such borrowers can plan their monthly budgets in advance, ensuring that they can afford to settle their education loan without straining their financial capacity and long-term objectives.

- Opens Door to Savings: With proper management of school loan EMI, such as utilising tax deductions and repayment plans, you can cut down the overall cost of the loan significantly, and this is a highly useful tool to save money.

- Personality Development: Firstly, you will be able to get a good education. Moreover, you are now self-dependent and no longer need to rely on or burden your parents. And most importantly, when you are paying for your fees on your own, it makes you more responsible and more focused on your studies.

How to Calculate Education Loan EMI

It is worth learning how to calculate the amount to pay to the Education loan EMI because it is necessary to plan how to pay every month and choose the right loan. You can add the principal loan amount, the rate of interest, and the period in a student loan EMI calculator or a mathematical formula to calculate the EMI.

EMI=Pr(1+r)n(1+r)n-1

Where:

- P = Principal loan amount

- R = Monthly interest rate (annual rate ÷ 12)

- n = Loan tenure in months

An Example,

You have taken an Educational loan of $50,000 at an interest rate of 10% for 4-year duration, that’s how you will calculate EMI.

| Step | Calculation | Value |

| Calculate Monthly Interest (r) | Annual Rate ÷12÷100 | 10%÷12÷100=0.00833 |

| Calculate Total Monthly Payments (n) | Tenure in Years ✕ 12 | 4 Years✕12=48 Months |

| Add Values into the Formula | EMI= 50,000✕0.00833✕(1+0.00833)48(1+0.00833)48-1 | EMI=$1,268.10 |

And,

| EMI | $1,268.10 |

| Total Repayment Amount ($1,268.10✕48) | $60,868.80 |

| Total Interest Paid | $10,868.10 |

1. Calculate with a Student Loan EMI Calculator:

Most lender websites have these convenient online calculators that can rapidly determine the amount of the EMI by typing in the loan amount, interest rate, and term. This saves time and ensures that the calculations are right, so as to do better financial planning.

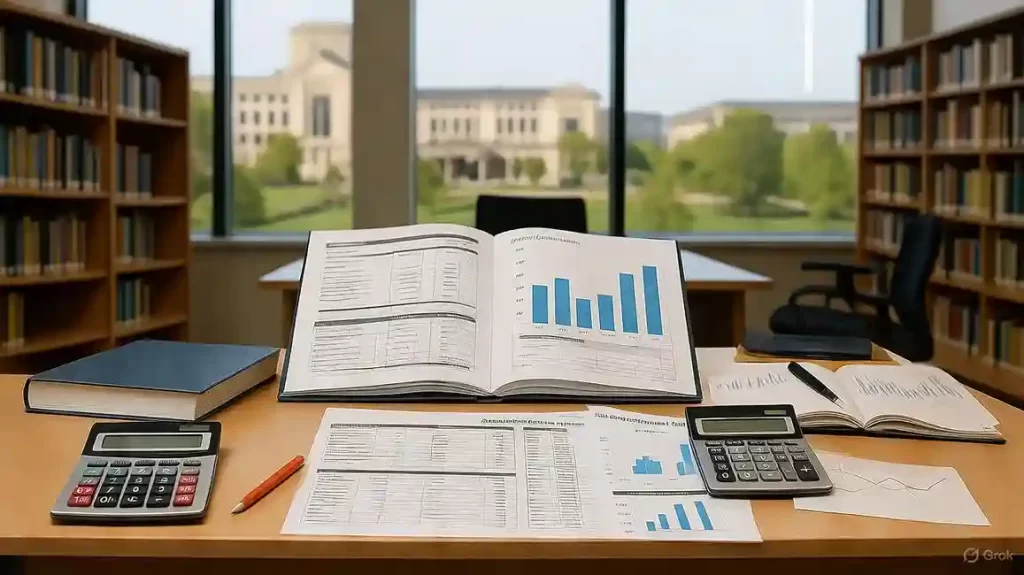

2. Compare Loan Offers to be Cost-Effective:

A student loan EMI calculator can enable borrowers to compare various loans and identify the loans that have lower interest rates or better terms to reduce the overall price of repaying their school loans.

3. Budget with Accuracy:

By calculating how much they will be paid in a single month, borrowers can determine how much they will need to make their monthly payments, and select a repayment option that fits them well without subjecting their finances to unnecessary strain in the future.

Education Loan Tax Benefits

Section 80 E tax deduction on Educational loans is an excellent option to make your education loan EMI cheap, because you can deduct the interest you are paying

- Information regarding the Section 80E tax deduction: Borrowers or their parents are eligible for a tax deduction on the interest component on the EMI of their education loan for most of eight years or until the interest is paid off. They are not restricted to deducting any amount, and this reduces their taxable income.

- Who is eligible to receive tax breaks: To receive a loan to fund higher education, whether in India or elsewhere, you need to borrow money from a bank or other recognised financial organisation. This encompasses undergraduate, graduate, as well as vocational programs.

- Section 80E: This Section 80E tax deduction reduces the sum of money that you have to repay on your school loan by decreasing your taxable income. It is a highly critical saving method, one that eliminates economic strain, and a great way to lower the overall cost of your education loan repayment.

Tips to Maximize Your Savings

Maximizing the benefits of your savings by paying off an education loan means taking some steps to reduce the interest payments you pay and have your money work harder to earn you.

1. Select a Shorter Term to repay a loan:

With a shorter term to repay the loan, one will pay less interest over the loan life itself, though it may have a higher monthly EMI. Calculate a student loan EMI using a student loan EMI calculator to find a loan term that is both affordable and allows you to save money.

2. Pay in advance to reduce the principal:

As far as possible, pay in the form of partial prepayments to reduce the amount of the principal. It will reduce the overall interest on the principal amount and might also reduce the duration of the loan. To avoid paying fines, you should always enquire with your lender regarding their prepayment policy.

3. Maximise Section 80E Tax Benefits:

This is to reduce your tax liability, ensure you receive the maximum interest paid on your student loan EMI under Section 80E. This will reduce the net cost of borrowing, and you will save more.

4. Check all the loan offers:

Check low-interest loans and those easy to easy-to-modify terms. Calculating the EMI of various loans with an education loan EMI calculator would perhaps aid in picking the one that is most affordable in the long run.

5. Begin Making Interest Payments:

Certain lenders provide the opportunity to make payments during the moratorium period, the time of studying, in addition to the grace period. Repaying the loan sooner reduces the interest that accumulates, which will save you a lot of money over the life of the loan.

Investing in your education is actually investing in your future self. It is true that not everyone is born with a silver spoon in their mouth. But using options like Educational EMIs, you can make your dream come true. So, don’t worry, just a little more hard work and you can be the best.

FAQs

What is an Education Loan EMI?

Education loan EMI refers to the monthly payment that you make in order to repay an education loan. It includes the main and the interest; therefore, you know the amount of money you will be paying at the end of the month.

What is the calculation of the EMI of an education loan?

To determine the monthly payment, use an EMI calculator for student loans or the EMI formula. All you have to do is enter the value of the loan, the interest rate, and the term. This will help you to have a better organization of your finances.

What are college loans’ tax breaks?

The interest that is paid on their EMIs in the first eight years of borrowing a student loan can be deducted by individuals who borrow a student loan under Section 80E. Their taxable income is reduced, and they can claim everything they wish.

Is it possible that prepayments would result in savings on college loan EMI?

The prepayments, yes, reduce how much interest you are paying, which can save you a significant amount of money, assuming it is done right, and can also reduce the length of the loan term, which can also save you a lot of money.

What about an EMI calculator for student loans?

A student loan EMI calculator allows borrowers to quickly calculate their EMIs, enabling them to consider loan options, budget, and choose repayment terms that reflect their financial priorities.

Conclusion

It is all about smart money management to make the education loan EMI worth it. By understanding how to calculate their school loan EMI, the benefits of an education loan tax reduction of Section 80E, and proactive approaches such as prepayments, shorter terms, borrowers can save much money on their borrowings. Such tools as the student loan EMI calculator ensure people can make smart decisions by ensuring that repayment of their student loans contributes to achieving their academic objectives and maintaining their financial stability in the future.