EMI Budgeting Tips for Financial Stability

Planning your finances today can be like walking through a maze, especially when you are a 9-5 employee getting a limited salary in this era of increasing demands and inflation. But don’t worry, as proper planning for EMIs and purchases made with Equated Monthly Installments (EMIs). will help you stay financially secure and free from the problem of overbearing debt. By involving EMI budgeting tips in your financial plan, you will be able to keep your monthly payments within the limit of your income and lifestyle aspirations.

EMIs are an important component of the finances of most people, especially for those who want to set a stage for a secure financial life. Without proper planning, these payments can strain your finances, providing very little scope for savings or other unexpected expenses. This article will help you learn about EMIs, determine how much EMI is safe, and give you practical tips on EMI budgeting to help you plan your finances in the right way.

What Are EMIs and Why Plan for Them?

An Equated Monthly Installment or EMI is a specific payable amount to the lender by a borrower on a fixed date of each month. It generally consists of the principal as well as interest on a loan, divided over a fixed tenure. Typical cases are home loans, car loans, or even consumer durable loans for household appliances.

It is important to plan for EMIs because;

- These payments are long-term and have a direct effect on your monthly cash flow.

- Planning prevents financial stress and burden.

- If not planned properly, EMIs can badly affect your budget, resulting in default payments, charges, or even a ruined credit history.

By following EMI budgeting tips, you can adjust your EMIs with your income so that you fulfill your commitment without compromising other financial goals, such as savings or investments.

How Much EMI is Safe?

How safe EMI is depends on your expenses, income, and financial goals. The key thing to keep in mind is the EMI to income ratio, which calculates the percentage of your monthly income that must go towards EMI payments. It is normally advisable that your total EMI payments must not cross a limit of a maximum of 40-50% of your monthly income. For instance, if your income is $1,000 per month, your overall EMIs should preferably remain at $400-$5,00.

For this reason,

- First, analyze your fixed expenses like home rent, electricity bills, and groceries.

- Then, make a pocket for surprise expenses, expenses to improve your lifestyle, and savings.

- Then set aside the remaining part of your income for EMIs.

- Make use of online EMI calculators to calculate payment amounts based on loan size, interest rate, and term, keeping the EMI within your means.

EMI Budgeting Tips for Management

Tips for effective EMI budgeting can simplify paying your EMIs and reduce stress. Here are some real-world strategies to include in your budgeting routine:

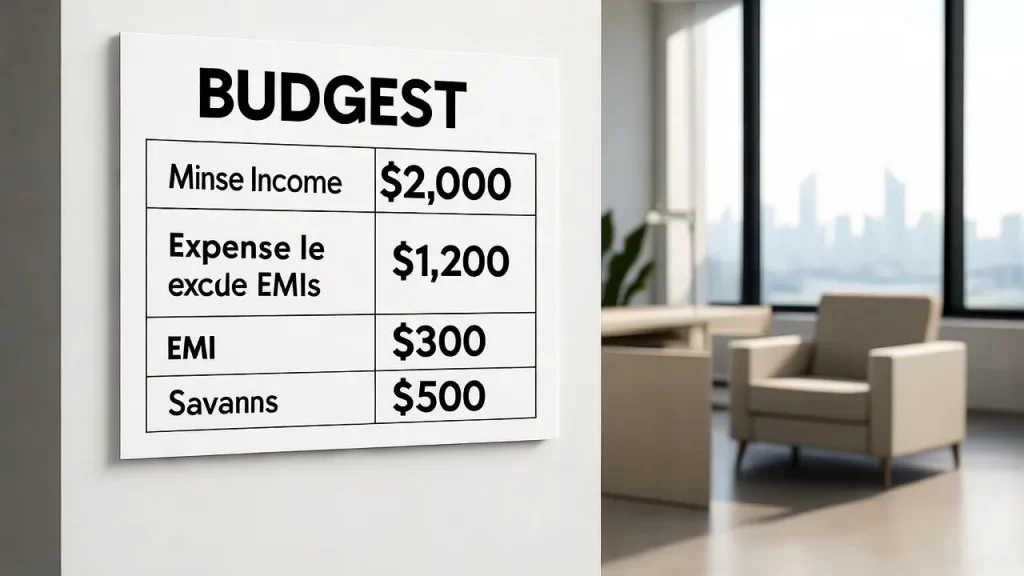

1. Make a Detailed Budget:

Evaluate your income and expenses to know your budget. List all your expenses first, including fixed expenses such as house rent and bills, and discretionary expenses. Then save some room for unwanted expenses that may result in case of emergency. This listing will give you a clear picture of your situation and help you determine your loan affordability.

For Example: Your monthly income is $2,000, and your expenses excluding EMIs are $1,200. If $300 is your monthly EMI, you will still be left with $500 that you can leave for savings or unexpected events. In case you run short of expenses, try reducing discretionary expenses.

2. Avoid Multiple Loans:

Taking up a single loan is like tying a knot with you; similarly, taking up multiple loans will be considered as multiple knots bound with you. The greater the number of these knots greater the number of chances of yourself to be stuck in a difficult position.

So, before taking up a loan for EMIs, cleverly evaluate your financial situation. Make sure how many loans you can afford at a time. If you think taking up multiple loans or EMIs can end up in a miserable situation, then it’s better to sacrifice your needs than to be stuck in that miserable situation.

3. Prioritize High-Interest Loans:

Now, let’s say you have taken up multiple loans and you need a strategy to minimize the burden as low as possible. This strategy, known as the avalanche method or prioritizing high-interest loans, will help you out.

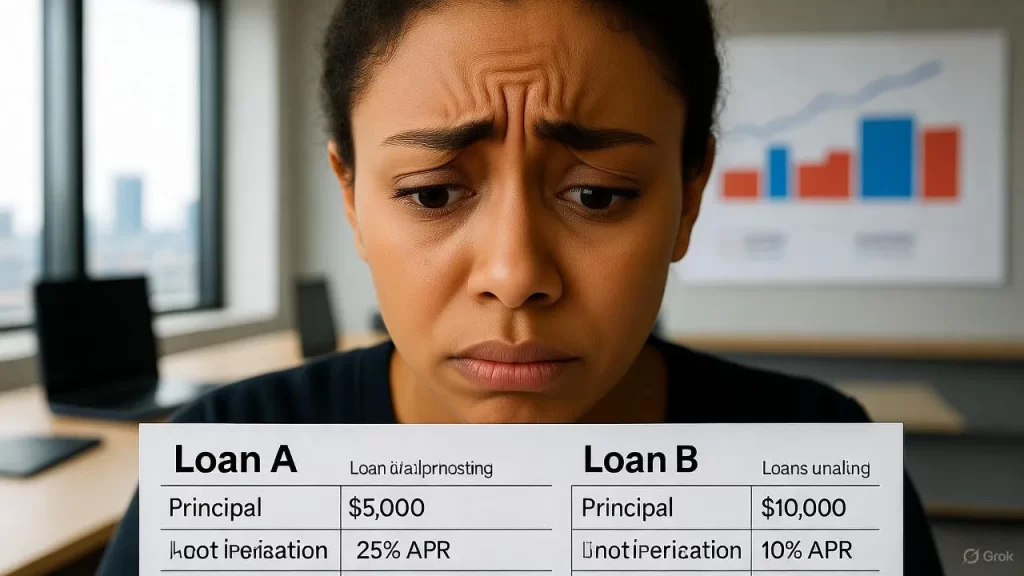

For Example: You have taken up two loans whose breakdown is written below,

| Loan | Principle Amount | Annual Percentage Rate | Minimum Payment |

| Loan A | $5000 | 25% | $100 |

| Loan B | $10,000 | 10% | $200 |

People may try to consider the larger debt first. But I would recommend focusing on that one which has a higher interest rate. As you can see in the above situation, Loan-A has a higher APR, which means it will increase significantly after a year. So after paying the minimum amount for each loan to avoid extra charges, you should then go for additional payments for the one with the higher interest rate.

4. Affordable Tenures:

You must go for a loan tenure that is affordable in the short term and results in the lowest amount of total interest paid. Longer tenures reduce monthly EMIs but add to the interest amount, whereas shorter tenures reverse this process.

For Example:

| Plans | Monthly Payment (EMI) | Total Interest Paid |

| 3 Years | $3,042 | $9,514 |

| 7 Years | $1,430 | $19,956 |

| 10 Years | $1,110 | $33,219 |

From this chart, you can learn that if you opt for the shortest plan, you will have to pay the lowest amount of total interest and vice versa.

5. Automate EMI Payments:

Missing payment dates for EMIs may result in late payment fines and also affect your credit score. It may happen to you too forget about the last date for payments. So, to avoid this problem, it is better for you to automate the payment. You can schedule payments using the banking apps or by consulting with your relevant bank officer.

6. Prepayments:

Make prepayments to lower the principal cost. For this purpose, you can consult the lender and discuss prepayment penalties. Make prepayments as much as possible to reduce the principal cost and total interest as well.

For Example: You have taken a loan of $20,000 at a 6.0% interest rate for 5 years with a standard EMI of $386.66. Here’s a comparison of how prepayments will impact your EMIs.

| No Prepayment | Prepayment 30% | |

| Monthly Payment | $386.66 | $386.66 |

| Loan Payoff Time | 60 Months or 5 Years | 41 Months or 3.42 Years |

| Total Interest Paid | $3,199.60 | $1,133.11 and saved $2,066.49 on total interest |

7. Build an Emergency Fund:

An unfortunate event can occur anytime to anyone. So, one should always get themselves fully prepared for any event, such as you may lose their job or any medical mishap that may affect their EMI payments. So, it is highly recommended to save 4-6 months of your expenses that will be the liquid cash in your savings account, which you can use at any time, before getting yourself involved in the circle of loans and EMI.

For Example: Your monthly expenses are $3,500, so you should aim for saving $16,000 to $21,000. So that if you are stuck in a hard time, you could use this fund to make your EMI payments while searching for a new job.

8. Refinancing Loan

Refinancing means borrowing a new loan to close out the old one, typically to get a lower interest rate or better term. It’s an excellent move if market rates have fallen or your credit rating has increased. It can save a huge amount of money in interest, but ensure to include closing costs or processing fees on the new loan

For Example: You took a loan of $100,000 previously at an interest rate of 7%. Now, you noticed that interest rates have dropped to 5%. So, you will refinance your loan by taking a new loan at a lower interest rate and paying off the previous loan. So, now you have to pay the same loan but with 2% lower interest rate.

9. Loan EMI Calculator

Using a loan EMI calculator to plan your EMI finance based on interest rate, loan amount, and its tenure is also a good strategy. Many EMI Calculating tools are available online that you can use for this purpose, such as EMI Loan Calculator, Home Loan EMI Calculator, and EMIcalculator.net.

| Loan Amount | Interest Rate | Tenure | EMI |

| $1000 | 12% | 1 Year | $88.85 |

| $1000 | 12% | 2 Years | $47.07 |

| $2000 | 10% | 3 Years | $64.53 |

10. Monitor and Adjust Regularly:

Your financial conditions may or may not be uniform. Rise and fall are part of life. You should prepare yourself strategically for each case.

For Example: As explained above, you should have emergency funds prepared in case of any downfall. Otherly, you are lucky to get a raise of $300/month. In this case, instead of increasing your discretionary expenses, you should worry about clearing your debts first.

By following these EMI budgeting tips, you can take charge of your finances and evade the risks of over-borrowing.

How to Manage Multiple EMIs

Managing multiple EMIs might be difficult, particularly if they take a huge portion of your income. Here are some tips to simplify how to manage multiple EMIs efficiently:

- Consolidate Loans: You can unite various loans to pay off at a single point in time at a lower interest rate to get off with burden as soon as possible, or you can increase the tenure to reduce EMI burdens.

- Prioritize Payments: High-interest loans can lead to an increase in debt over time. So you must focus on paying them off first to minimize the total amount you have to pay.

- Use the Snowball or Avalanche Method: The snowball method focuses on clearing smaller loans first, while the avalanche method targets high-interest loans to save on interest costs.

- Negotiate with Lenders: If you’re struggling with a hard time, contact your lender to explore options like restructuring the loan or extending the tenure to lower monthly payments.

- Track Payment Schedules: Use a calendar or budgeting app to monitor EMI due dates and avoid delayed payments. This will help you maintain a better credit score

With organized payments and access to consolidation options, you can make it simpler to manage multiple EMIs and relieve financial strain.

Financial Planning with EMI

Including EMIs in your financial plan is the key to stability over the long term. EMI-based financial planning is when your loan repayment is synchronized with your other financial goals, including retirement savings, education, or significant life events. Begin by establishing definite financial goals and charting out where EMIs fit into your budget.

The 50/30/20 Rule

This rule quotes the plan to manage your finances by dividing your income into 3 parts;

Income Breakdown,

- 50%: This involves all your necessary expenses, such as household expenses, including your bills, maintenance, groceries, fees, and a lot more that you have to care about at all costs.

- 30%: These are actually non-essential expenses, but you want to spend on to increase or enhance your lifestyle.

- 20%: It’s the remaining income that you have to save. Save for your future or to pay off debts.

20% for EMI

Now you know how to break down your income, and you must be thinking which portion I should include in paying off EMIs. So, that 20% portion of your income or savings must be the one that you must use to pay EMIs. In this way, you will get the least burden possible and get anything you want. So, now you just have to manage the budget of the goods you want in that specific portion. This is the ideal way of planning EMI finances.

Why EMI Planning Matters

EMI planning is important because it has a direct effect on your financial well-being.

- A poorly planned EMI can result in debt traps, delayed payments, and a poorer credit score, leading to more costly or harder borrowing in the future.

- Well-planned EMIs enable you to meet your goals, whether it is purchasing a home, vehicle, or financing education, without risking your financial health.’

- EMI planning educates you to borrow sensibly and have control over your finances.

By managing your EMI to income ratio and sticking to EMI budgeting tips, you can prevent living paycheck to paycheck and establish a strong financial ground.

Remember, EMIs are not restrictive, but a liberty to get whatever you want without sacrificing your future self

FAQs

What is a safe EMI to income ratio?

A safe EMI to income ratio is usually in between 40-50% of your monthly salary. This leaves you with sufficient funds for other expenses and savings. However, spending 20% in EMIs is the most ideal way.

How can I lighten my EMI burden?

The EMI burden can be lightened by choosing the long-term plans that will reduce the monthly payable amount. Or you can make a prepayment to reduce the principal amount and total interest.

Is it advisable to have one EMI or multiple EMIs?

Taking up a single EMI is advisable as subscribing for multiple ones is like riding on multiple boats at a time. It can seriously affect your finances. However, it all depends on your income and budget whether you can afford it or not.

Can I prepay my EMIs?

Yes, in most loans, it is possible to make a prepayment,ments, which can lower the principal amount and total interest. Moreover, you can consult your lender about prepayment penalties.

How often should I review my EMI budget?

Revisit your budget every 6-12 months or whenever your income or expenses undergo a serious change to ensure EMIs are still manageable.

Conclusion

EMI planning is the basis of financial security. Knowing how much EMI is safe, keeping your EMI to income ratio in check, and following real-life EMI budgeting tips, you can ride your loans without affecting your financial objectives. Whether it is dealing with one EMI or calculating how to manage multiple EMIs, strategic financial planning with EMI keeps you on course. Begin today by evaluating your budget, scheduling repayments, and creating a safety net to ensure your financial future.