Cardless EMI Options: How to Buy on Cardless EMI

In today’s fast-paced world, making big-ticket purchases like smartphones, laptops, or home appliances doesn’t have to mean draining your savings account all at once. Enter cardless EMI—a game-changing payment solution that lets you spread the cost over manageable monthly installments without needing a credit or debit card. Whether you’re eyeing the latest gadget during a festive sale or upgrading your home setup, cardless EMI options make shopping accessible, affordable, and hassle-free.

In this article, we’ll dive deep into what cardless EMI entails, explore available options, eligibility criteria, step-by-step guidance on how to buy on cardless EMI, and even spotlight cardless EMI on Amazon. Plus, we’ll compare it head-to-head with traditional credit card EMI to help you decide what’s best for your wallet.

What is Cardless EMI?

Cardless EMI is a digital financing method that allows you to convert high-value purchases into easy equated monthly installments (EMIs) without requiring a credit or debit card, making it ideal for those without established card histories or seeking a secure, contactless payment option. By partnering with banks like ICICI, HDFC, or fintech providers like ZestMoney, it uses simple verification through mobile number, PAN, and OTP for instant approval, with pre-approved credit limits up to ₹5 lakh based on your profile. Key features include:

- No Card Required: Transactions are processed digitally, eliminating the need for physical or virtual cards and reducing fraud risks.

- Instant Approval: Eligibility is checked in seconds using mobile and PAN details, with no lengthy paperwork.

- Flexible Tenures: Choose repayment periods from 3 to 48 months, often with no-cost EMI options where interest is subsidized.

- Wide Availability: Offered by major retailers and e-commerce platforms like Amazon, Flipkart, and Reliance Digital.

- Secure and Accessible: Ideal for first-time credit users, with minimal documentation and no credit score dependency in many cases.

Cardless EMI Options

India’s fintech ecosystem is buzzing with cardless EMI options, catering to diverse needs from no-cost plans to flexible tenures. These services partner with major retailers and e-commerce platforms, offering limits from ₹10,000 to ₹5 lakh and repayment periods up to 48 months. Here’s a quick overview of popular cardless EMI options:

| Provider | Key Features | Minimum Purchase | Tenure Options | Partners/Availability |

| ICICI Bank Cardless EMI | Instant approval via mobile & PAN; no-cost EMIs | ₹10,000 | 3-15 months | Croma, Reliance Digital, 2,500+ e-com brands |

| HDFC Cardless EasyEMI | For all bank customers; QR scan at POS | ₹5,000 | Up to 24 months | Flipkart, Amazon, VLCC |

| Bajaj Finserv Insta EMI Card | Digital card access; no down payment | ₹1,500 | 1-60 months | 1M+ products across electronics, furniture |

| ZestMoney | No credit score needed; zero down payment | ₹500 | 3-12 months | Flipkart, Mi, Croma |

| Snapmint | UPI/debit card linked; no-cost focus | ₹2,000 | 3-12 months | Online/offline stores like electronics shops |

| InstaCred | Buy now, pay later; integrated with e-com | ₹1,000 | 3-12 months | Amazon, Flipkart, IDFC/HDFC tie-ups |

These cardless EMI options are expanding rapidly, with fintechs like Razorpay and PayU enabling seamless integration for merchants. Choose based on your shopping habits—e.g., ZestMoney for gadget lovers or Bajaj for broad categories.

Cardless EMI Eligibility

Wondering if you qualify for cardless EMI? The good news is that it’s more inclusive than credit card EMIs, often bypassing strict credit scores. Eligibility is typically assessed via a quick digital check using your mobile, PAN, and basic KYC details. Providers like ICICI and HDFC target pre-approved customers, but many fintechs welcome first-timers.

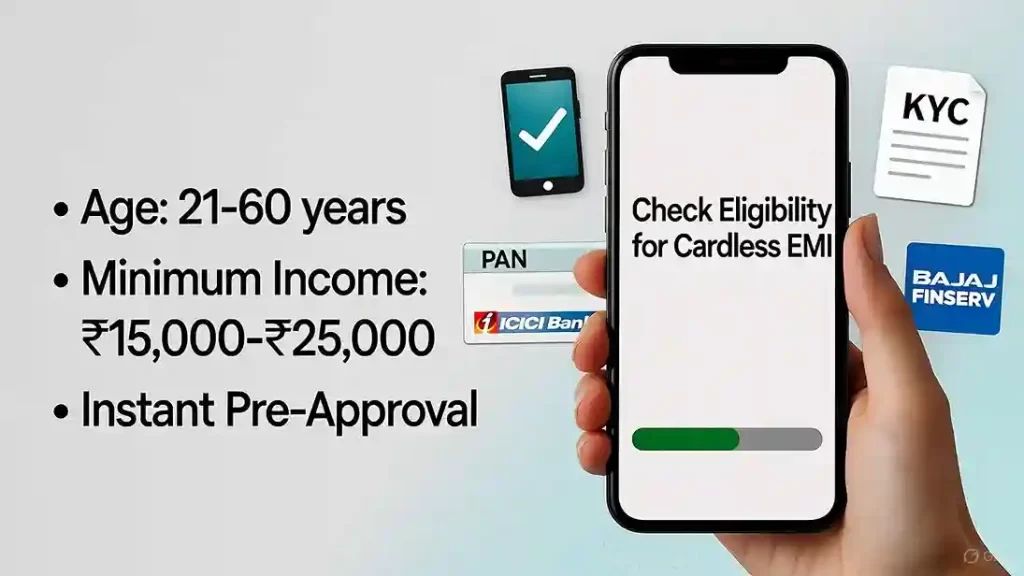

Key cardless EMI eligibility criteria include:

- Age: 21-60 years (salaried) or 24-60 (self-employed).

- Income: Minimum ₹15,000-₹25,000 monthly, depending on the provider (e.g., Bajaj requires proof via bank statements).

- Documents: PAN card (mandatory), Aadhaar for e-KYC, and registered mobile number. No credit card needed, but a fair CIBIL score (above 700) helps for higher limits.

- Other Factors: Indian resident, no active defaults, and sometimes a linked bank account for auto-debits.

To check: SMS ‘CF’ to 5676766 for ICICI or use apps like Bajaj Finserv for instant pre-approval. Approval is often instant, with limits based on your profile—up to ₹5 lakh for trusted users. If ineligible, build credit via small UPI transactions first.

How to Buy on Cardless EMI

Ready to snag that dream purchase? Buying on cardless EMI is straightforward and takes minutes. Here’s a step-by-step guide tailored for both online and offline scenarios:

- Select Your Product: Browse at a partner store (e.g., Reliance Digital) or e-commerce site (e.g., Flipkart). Ensure the item qualifies for EMI (usually ₹1,000+).

- Choose Cardless EMI at Checkout: For offline, inform the store rep; for online, select “EMI” > “Cardless” on the payment page.

- Enter Details: Provide your 10-digit mobile number and PAN. An OTP will arrive—verify it instantly.

- Check Eligibility & Limit: The system pulls your pre-approved limit (e.g., via HDFC’s QR scan). If approved, view customized offers.

- Pick Tenure & Confirm: Choose months (3-24) and EMI amount. Complete e-mandate with bank details for auto-payments—no down payment needed.

- Complete Purchase: Pay via UPI/debit if prompted for the first installment. Get instant confirmation; track via app.

Pro Tip: Use tools like EMI calculators on provider apps to preview costs. For Bajaj Insta EMI, apply online first for a virtual card. Always verify no hidden fees!

Cardless EMI on Amazon

Amazon has revolutionized cardless EMI on Amazon with seamless integrations, making it a top choice for online shoppers. Through Amazon Pay Later (APL) and partners like Kotak, ICICI, and InstaCred, you can split purchases from mobiles to appliances into EMIs without cards. Limits go up to ₹60,000, with tenures of 3-12 months and no-cost options on select deals.

Steps for Cardless EMI on Amazon:

- Add items to cart (min. ₹900 for some providers).

- At checkout, select “Amazon Pay Later” or “EMI” > “Cardless.”

- Enter mobile/PAN, verify OTP, and choose tenure.

- A 1.18% processing fee applies for APL EMIs (GST included), refunded proportionally on returns.

It’s exclusive to pre-approved users, but setup takes just 2 minutes—no credit card details required. Festive sales often feature zero-down-payment deals, boosting affordability.

Cardless EMI vs Credit Card EMI

Both cardless and credit card EMIs ease big buys, but they differ in accessibility and costs. Cardless shines for non-cardholders, while credit card EMI suits rewards chasers. Here’s a side-by-side comparison:

| Aspect | Cardless EMI | Credit Card EMI |

| Requirement | Mobile, PAN, OTP; no card needed | Valid credit card with limit |

| Eligibility | Broader (low/no credit score OK) | Good CIBIL (750+), income proof |

| Interest | Often no-cost; low processing fee | 12-18% p.a. (adjusted in no-cost) |

| Tenure | 3-48 months | 3-24 months |

| Fees | 1-2% processing + GST; no forex | Processing fee (₹99-₹500) + GST |

| Accessibility | Instant digital approval | Bank-dependent; 2-4 days processing |

| Rewards | Limited; focus on affordability | Cashback, points on spends |

| Best For | First-timers, high-value one-offs | Frequent shoppers, reward maximizers |

Cardless EMI edges out for simplicity and inclusivity, avoiding credit utilization hits. Credit card EMI, however, builds credit faster via timely payments.

FAQs

Is cardless EMI really interest-free?

Yes, no-cost cardless EMI plans are interest-free, as merchants or providers absorb the interest to make purchases affordable. Always check terms for any processing fees, such as Amazon’s 1% fee plus GST, to ensure transparency.

Can I prepay my cardless EMI?

Most providers allow prepayment, though a nominal foreclosure fee (1-2% plus GST) may apply depending on the lender. Contact your provider’s app or customer care to initiate early repayment and confirm exact charges.

What if I miss an EMI payment?

Missing an EMI incurs late fees (typically ₹500-₹1,000) and can negatively affect your credit score, making future loans harder to secure. Set up auto-debit or reminders via the provider’s app to stay on track.

Are refunds easy with cardless EMI?

Refunds are straightforward but may take 7-10 days to process, with EMIs adjusted post-return to reflect the refunded amount. Ensure you initiate returns within the merchant’s policy period for smooth processing.

Which is safer cardless or credit card EMI?

Cardless EMI is generally safer since it doesn’t involve sharing card details, reducing risks of fraud or data breaches. Its digital verification via OTP and PAN ensures secure, contactless transactions.

Conclusion

Cardless EMI options are transforming how we shop, democratizing access to flexible financing without the barriers of traditional cards. From quick approvals via mobile and PAN to no-cost tenures on platforms like Amazon, it’s a boon for budget-conscious buyers. Whether you’re weighing cardless EMI vs credit card EMI or just starting with eligibility checks, the key is choosing what aligns with your lifestyle—affordability, rewards, or simplicity. Dive in, explore providers like Bajaj or ICICI, and make that purchase today. Smart shopping awaits—pay later, live better!