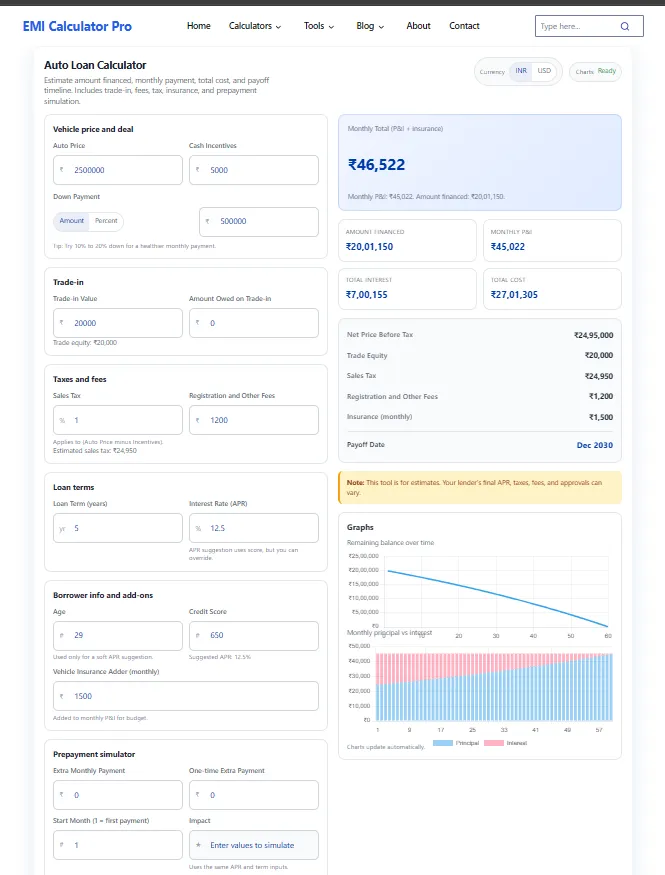

Vehicle price and deal

Trade-in

Trade equity: ₹0

Taxes and fees

Estimated sales tax: ₹0

Loan terms

Borrower info and add-ons

Prepayment simulator

Monthly Total (P&I + insurance)

₹0

Monthly P&I: ₹0. Amount financed: ₹0.

Graphs

Remaining balance over time

Monthly principal vs interest

If charts do not load, your results still work.

Like me, it is the dream of every man to get financially stable one day and get his own dream car. Indeed, it is an exciting milestone, but if you are going towards financing your car, that just requires careful financial planning. Then there are several options in the market, but which one is the best for you? Indeed, the one in the budget. That’s why there is a car loan eligibility calculator that calculates how much of a car loan you can qualify for. Once you know your eligibility, calculate exact auto monthly payments.

In this article, I will discuss these important points regarding car loan finance. How can you use a car finance eligibility calculator or an auto loan eligibility calculator? And the quickest and easiest way to check car loan eligibility.

How to Check Car Loan Eligibility Online

It has made it easier to check my car loan eligibility from home. Also the most banks and financial websites offer free eligibility tools.

Steps to Use EMI Calculator Pro Car Loan Eligibility Calculator:

- Go to car Loan eligibility calculator

- First, add vehicle price and deal details, including the Auto price, cash incentives, and down payment.

- Add trade-in details.

- Indeed, tax and processing fees will be applicable, so it is also important to consider them in the next step.

- Add the loan terms in years and the interest rate.

- Add borrower info.

- Next, add additional payment info if any, and the EMI Calculator will get the eligibility details for you.

This process is quick, usually taking under a minute, and doesn’t affect your credit score.

Key Factors Determining Eligibility for a Car Loan

From your income to your credit history, there are several key factors that may affect your car loan eligibility. Lenders always consider these points, especially when issuing larger loans

Main Factors Influencing Eligibility:

- Credit Score: Credit score depends on your repayment frequency or how well you are at repaying loans. A score of 700+ is considered a good credit score. But if your repayment frequency is bad, it may lower this core, and you may suffer hindrances while applying for a loan. If your score is low, learn how missed payments affect.

- Income and Stability: Whether you are salaried or self-employed, the lender will check your income status and the stability of your income, such as 1+ years for a salaried person and 2-3 years for self-employed.

- Debt-to-Income Ratio (DTI): Your existing EMIs should not exceed 40-50% of your income.

- Age and Employment: Typically 21-65 years old may apply for loans. Younger individuals have a better chance of loan approval.

- Down Payment: You should try making down payments as larger down payments reduce the loan amount and improve eligibility.

| Factor | Ideal Criteria | Impact on Eligibility |

| Credit Score | 750+ | High – Better rates and higher amounts |

| Monthly Income | ₹25,000+ (varies by lender) | Determines the max loan based on EMIs |

| Existing Obligations | Low DTI (<50%) | Reduces risk for the lender |

| Employment Stability | 1+ year (salaried) / 3+ years (business) | Proves repayment capacity |

| Age | 21-65 years | Standard requirement |

Used Car Loan Eligibility Check:

When you go to finance a used car or a second-hand car, there are some relaxations in the rules due to the lower value of the car. You could use the Car Loan Eligibility Calculator for a used car loan eligibility check, too.

Key Differences for Used Cars:

- Used cars have a low Loan-to-Value (LTV) ratio (often 70-90% of car value vs. up to 100% for new cars).

- In this case, the car age is the most important factor; usually 8-10-year-old car may not qualify for loan financing.

- The loan to be eligible for a loan can be lowered.

- But there are risks in financing a used car, so the interest rates might be slightly higher than usual.

Popular lenders like Bajaj Finserv and ICICI Bank offer specific used car loan eligibility calculators to help you plan. Here you can also check car loan using car loan emi calculator.

Benefits of Using a Car Finance Eligibility Calculator

- Realistic Budgeting: Before shopping, you know what you can afford.

- Time-Saving: It is a handy tool and can be used at any time, so you don’t need to contact any agent and so.

- Comparison Shopping: You can apply various rates and calculations, and also compare different offers from different lenders.

- No Obligation: You can check on your own; there are no obligations on your end, and it will never impact your credit score.

Frequently Asked Questions (FAQs)

What is a calculator for determining whether you can get a car loan?

It is an online tool that would help calculate how much money you can borrow depending on your income, credit, and debts. It allows you to use the online check to determine whether you can secure a vehicle loan or not.

To what extent are these calculators correct?

They are a good approximation, but they require thorough checking to be certified. The lender will always verify to get the exact numbers.

Is it possible to determine the fact that I can be provided with a used auto loan?

There are indeed many banks that offer special tools, which will enable you to check whether you can take out a used car loan depending on what the car is and how old it is.

Am I required to have a high credit score to get this?

If you score 700-750 or more, then you have a great chance of approval and a reduction in your rates on any eligibility calculator of auto loan.

Can eligibility be checked safely and freely?

Yes, the majority of the internet tools are free and have soft checks that do not damage your credit score.

Conclusion

The initial step towards sensible auto financing would be to use a car loan eligibility calculator. Early checking your eligibility with the help of a tool gets you confidence, allows you to save some surprises, and gets you better terms, regardless of whether you are purchasing a new or used car. Go to the EMI Calculator Pro website that you trust today and embark on your car-buying adventure!